In response to the results of the 2012 election, John O. McManus – top AV-rated tax and estate planning attorney and founding principal of Tri-State-Area-based McManus & Associates – released the following guide to changes in tax rates and exemptions, as well as a statement below:

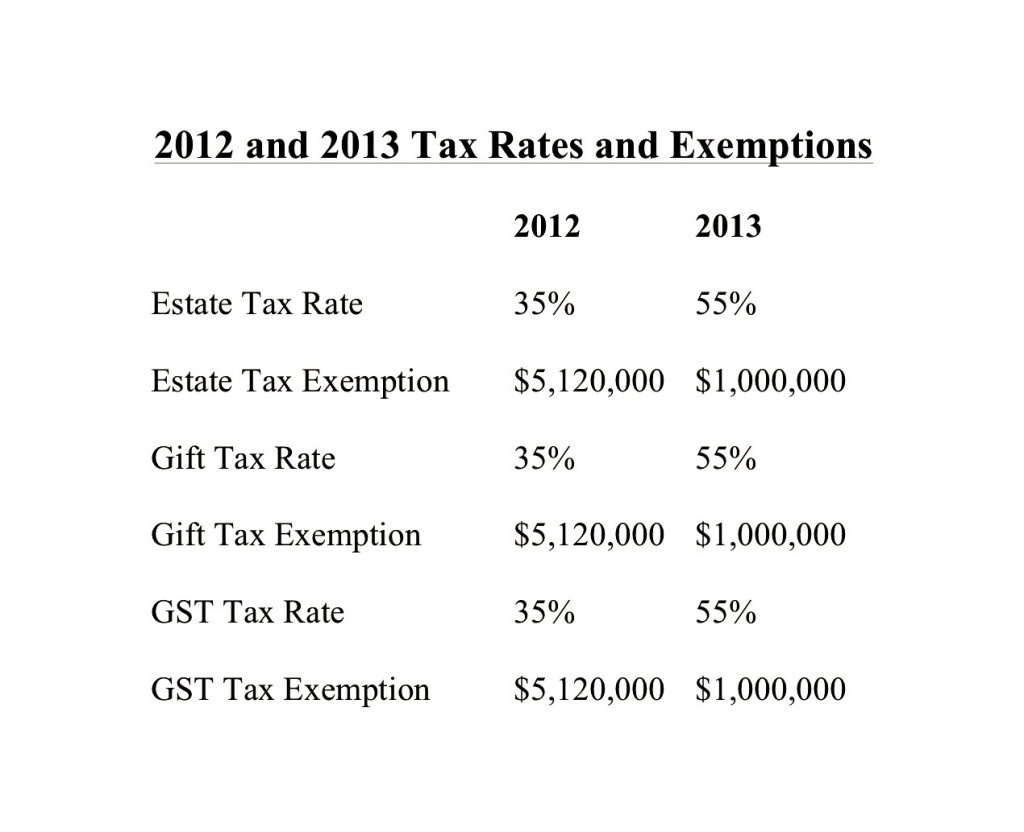

What does President Obama winning re-election mean for estate planning? Answer: Certain estate planning strategies are set to expire with no expectation that they will be extended. We must get to work now while we still have the opportunity. The gift tax exemption, currently allowing individuals to transfer up to $5,120,000 in assets free of tax retreats to $1,000,000 at the end of this year, and the gift tax rate jumps from 35% to 55%.

As we hurl toward the fiscal cliff of 2013, Speaker Boehner and President Obama now draw lines in the sand assuring an end to this unique tax opportunity. Furthermore, if and when a compromise is achieved – possibly sometime next year – the death tax and gift tax rates will likely increase significantly, and the tax benefits will fall to less than 20% of what is available through year-end.

More than ever, it is now critical to hop on this last tax-planning train before this period dissolves to the disadvantage of loved ones.

Rather than giving gifts directly to loved ones, transfers should be made into trust to provide flexibility, control and access to the donor. Assets such as business interests, private equity ownership, stock portfolios, cash and real estate are all suitable for transfer. Employing qualified professionals can assure that this work can be completed in less than 30 days – just enough time to make the deadline. Missing this twilight period could prove to be taxing on your mind and your balance sheet.

Please contact us immediately to learn how to take advantage of this fast-closing window of time as the end of 2012 approaches — we have at least another month to help.

⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩