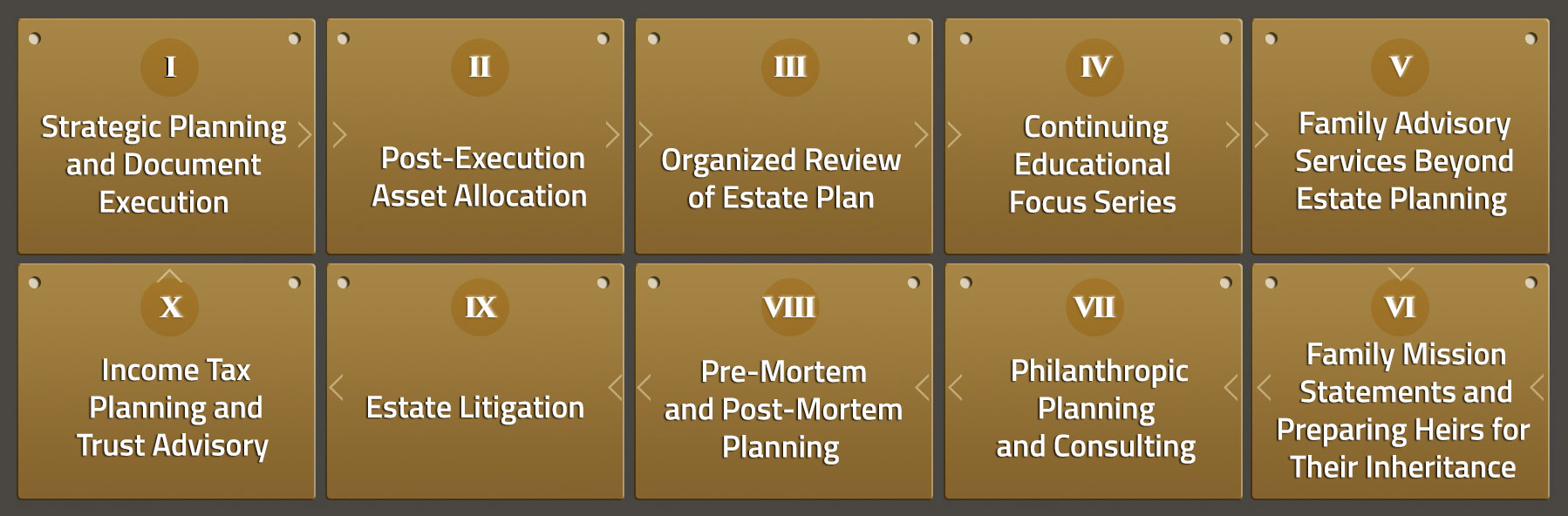

McManus & Associates has developed a clear process for the preparation and completion of a client’s estate plan. At every step along the way, our team ensures that the client’s wishes and intent are fully integrated into the final product. The partnership begins with the initial conversation and continues throughout the professional relationship to include coordination with the client’s other professional financial relationships, recommendations concerning asset allocation, and more advanced planning.

⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩