In the early morning hours of January 1, the United States Senate passed legislation to avoid the ‘fiscal cliff.’ Nearly 20 hours later the House followed suit. Several surprising outcomes regarding estate planning emerged as part of this deal, which according to the Wall Street Journal, is “chock full of goodies” for nearly every interest group. The Estate Planning community was surprised to enjoy the benefit.

John O . McManus, top AV-rated estate planning attorney and founding principal of McManus & Associates, today held a conference call with clients about the new laws and ways to remain protected moving into 2013.

LISTEN HERE: “Post-Fiscal Cliff Estate Planning – Top 10 Next Steps in Light of the Deal”

Below please find the 10 questions that are addressed during the discussion:

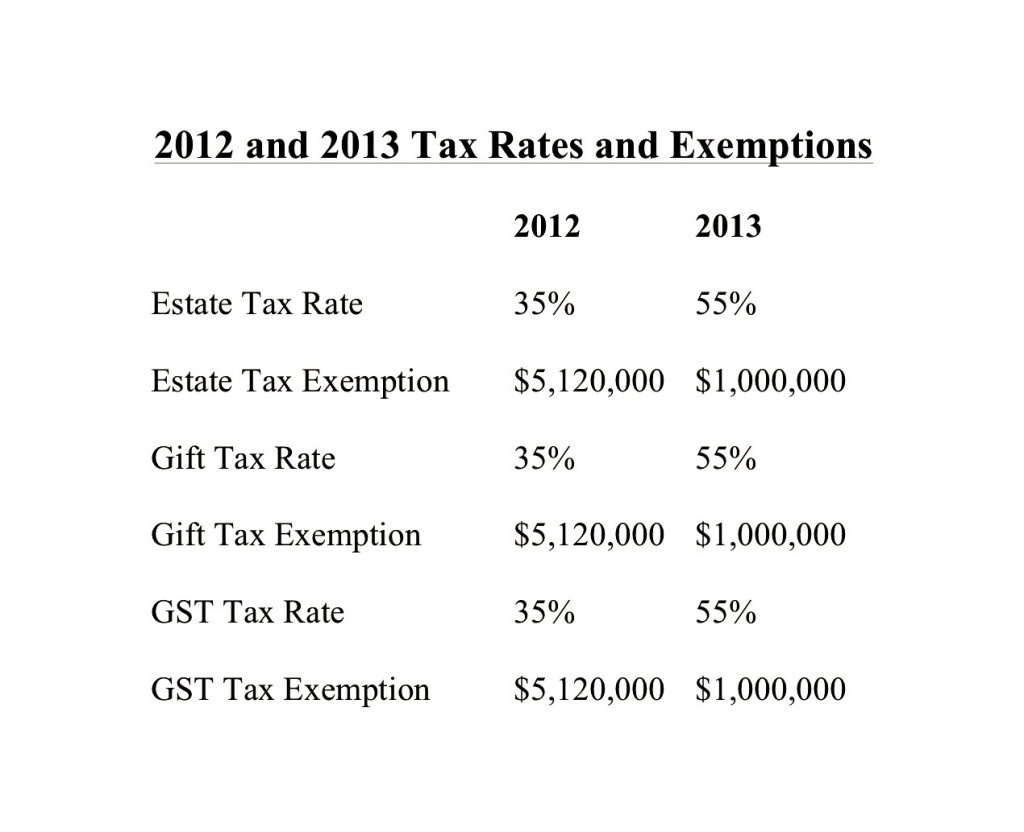

1. The new tax rates and exemption amounts are set. What can you expect to pay for estates over $5.25MM?

2. What are the estate-tax “traps” to be wary of?

3. The Connecticut gifting limit of $2MM; is this a warning for future lifetime gifting limits in other states?

4. With the new permanency in the estate tax exemption, what taxpayers should make gifts over $5.25 MM and pay gift tax? (A strategy widely used for many prior generations)

5. For estates below $5.25 MM, who should employ trusts in their wills?

6. What is meant by “spousal portability” and “unification” of the exemption amounts? Does this eliminate the need for certain planning?

7. The Generation Skipping Tax Exemption Amount is also set at $5.25MM; who should take advantage of it?

8. Looking forward to March ’13 and the “debt ceiling” debates, what detrimental effect could such negotiations have on state estate taxes?

9. What are the trust and non-trust estate planning strategies that married and single persons should undertake in 2013?

10. What critical Gift Tax consequences must be avoided for gifts made in 2012? When does the statute of limitations clock begin?

McManus & Associates is here to help you make sure you’re covered. We welcome your call at 908-898-0100.

Freda’s December 27th story “IRS Shuts Down Online EIN Applications, Complicating Year-End Gift Transactions” cites John’s thoughts on the IRS’s “planned outage” of online applications for employer identification numbers, from December 27th through January 2nd. It was the publication’s most-read article of the day.

Freda’s December 27th story “IRS Shuts Down Online EIN Applications, Complicating Year-End Gift Transactions” cites John’s thoughts on the IRS’s “planned outage” of online applications for employer identification numbers, from December 27th through January 2nd. It was the publication’s most-read article of the day.

⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩ ⟩

⟩